For anyone delving into the world of global finance and investments, the term “HDFC Bank ADR” might have surfaced frequently. But what does it actually signify? If you’re curious about what “HDFC Bank ADR means” and why it matters in the financial landscape, you’re in the right place. In this comprehensive article, we’ll unpack the concept, its implications, and the benefits and challenges associated with it. Let’s dive in!

Table of Contents

What Does “HDFC Bank ADR” Mean?

At its core, ADR stands for American Depositary Receipt. It’s a financial instrument that represents shares of a foreign company traded on U.S. stock exchanges. When it comes to HDFC Bank, an ADR allows American investors to invest in one of India’s leading banks without the complexities of international trading.

To break it down further, when someone refers to “HDFC Bank ADR means,” they’re discussing how the bank’s shares are accessible to U.S. investors through a simplified mechanism. These ADRs are issued by U.S. banks and are backed by shares of HDFC Bank, held in custody in India. Essentially, ADRs make cross-border investments more accessible and efficient.

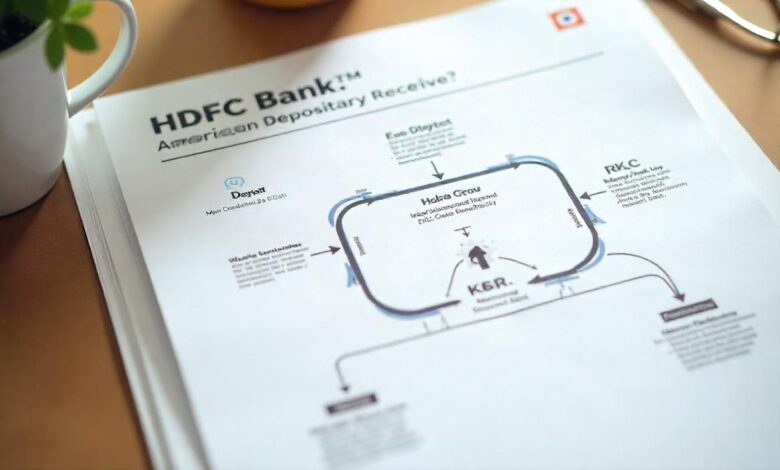

1. How Does HDFC Bank ADR Work?

Understanding “HDFC Bank ADR means” requires a look into its operational mechanism:

- Issuance: A U.S. depositary bank buys shares of HDFC Bank in India and issues ADRs to American investors.

- Trading: These ADRs are traded on U.S. exchanges, such as the NYSE, in U.S. dollars.

- Dividends: If HDFC Bank declares dividends, they are converted to dollars and distributed to ADR holders.

This process ensures that American investors can easily invest in HDFC Bank while bypassing the complexities of foreign exchange and international stock trading rules.

2. Advantages of Investing in HDFC Bank ADR

Why should investors care about “HDFC Bank ADR means”? Here are some compelling reasons:

Accessibility:

ADRs eliminate the need for investors to open overseas trading accounts or deal with Indian regulations.

Diversification:

Investing in HDFC Bank ADR allows American investors to diversify their portfolios by gaining exposure to India’s banking sector.

Currency Simplification:

All transactions occur in U.S. dollars, reducing currency exchange hassles for American investors.

Credibility:

HDFC Bank is one of India’s largest and most trusted banks. Its ADR is backed by a solid financial institution with a strong performance history.

By understanding what “HDFC Bank ADR means,” investors can see how it bridges the gap between global opportunities and local convenience.

3. Key Risks Associated with HDFC Bank ADR

While the advantages are notable, there are also risks to consider when exploring “HDFC Bank ADR means”:

Currency Fluctuations:

Even though ADRs are traded in dollars, the underlying shares are denominated in Indian Rupees. Any fluctuation in exchange rates can impact returns.

Regulatory Differences:

India and the U.S. have different financial regulations. Changes in Indian banking laws or taxation can influence the performance of HDFC Bank ADRs.

Market Volatility:

The Indian stock market, where HDFC Bank’s shares are listed, is susceptible to volatility. This can indirectly affect the ADR price in the U.S.

By keeping these risks in mind, investors can make informed decisions about HDFC Bank ADRs.

4. How to Invest in HDFC Bank ADR

Interested in exploring “HDFC Bank ADR means” from an investment perspective? Here’s a step-by-step guide:

- Open a Brokerage Account: Ensure your broker supports trading in ADRs.

- Research HDFC Bank ADR: Understand its current market performance, historical data, and analyst predictions.

- Place an Order: Buy HDFC Bank ADRs on U.S. stock exchanges just like any other stock.

- Monitor Your Investment: Keep track of HDFC Bank’s performance in India and any global economic developments.

Investing in ADRs like HDFC Bank can be an excellent way to tap into international markets, provided you do your due diligence.

5. HDFC Bank ADR vs. Direct Investment

A common question when understanding “HDFC Bank ADR means” is how it compares to directly investing in Indian markets. Here’s a quick comparison:

| Feature | HDFC Bank ADR | Direct Investment in India |

|---|---|---|

| Ease of Access | High, via U.S. exchanges | Requires opening an Indian trading account |

| Currency | U.S. Dollar | Indian Rupee |

| Regulations | Subject to U.S. financial rules | Governed by Indian laws |

| Dividend Payouts | Paid in dollars | Paid in rupees |

For American investors, ADRs offer a hassle-free alternative to gain exposure to Indian stocks without navigating foreign trading systems.

Conclusion: Why “HDFC Bank ADR Means” Matters

Understanding what “HDFC Bank ADR means” is crucial for investors looking to diversify their portfolios with international assets. HDFC Bank’s ADRs provide a unique opportunity to tap into India’s growing banking sector while enjoying the convenience of U.S.-based trading.

With the right approach, investing in ADRs can be a valuable addition to your financial strategy. Keep in mind the benefits, risks, and research thoroughly before diving in.

FAQs About HDFC Bank ADR

1. What is HDFC Bank ADR?

HDFC Bank ADR is an American Depositary Receipt that represents shares of HDFC Bank, allowing U.S. investors to trade the bank’s shares on U.S. stock exchanges.

2. How can I buy HDFC Bank ADR?

You can buy HDFC Bank ADR through a brokerage account that supports ADR trading on U.S. stock exchanges.

3. What are the benefits of HDFC Bank ADR?

It provides easy access to Indian stocks, transactions in U.S. dollars, and portfolio diversification.

4. Are there risks associated with HDFC Bank ADR?

Yes, risks include currency fluctuations, regulatory differences, and market volatility.

5. Where can I find HDFC Bank ADR listed?

HDFC Bank ADRs are listed on major U.S. stock exchanges, such as the NYSE.

6. How does HDFC Bank ADR differ from direct investment in India?

While ADRs are traded in dollars on U.S. exchanges, direct investment requires Indian trading accounts and deals in rupees.

7. Can I earn dividends through HDFC Bank ADR?

Yes, dividends are paid out in U.S. dollars to ADR holders.